How To Manage an Insurance Claim on Your Home

Mar 29, 2024

They say nothing good happens after midnight—especially at 3:22 A.M.

It was exactly that time when the large cedar tree in your backyard gave in to the wet ground and driving wind. You’ll never forget the sound it made as it crashed through your roof. The kids are fine. Your partner is shaken but okay. You gather yourself and come to terms with what is in front of you: a massive mess of wood and water. Water is still gushing in from the storm outside, so it is now partly inside. You call a 24-hour emergency service, and by noon the next day, there is temporary waterproofing along with fans and dehumidifiers to mitigate water damage.

Within a few weeks, insurance comes and produces an estimate. They offer you a check. You take it, cash it, and start the process of getting bids. This is the most common step—and a fatal error—when homeowners are dealing with insurance. Once they get that check, most homeowners find themselves getting bids that are double, even triple, the amount they were given.

So why is it like this?

Understand Your Policy

Insurance companies generate most of their income from your premiums. They use a complex combination of factors to get to a premium amount, but the main ones are:

a history of claims

your credit score and history

the general neighborhood

coverage options selected

coverage amount needed or requested

crime rate in the area

the general condition of your home

If you are reading this article to research your home insurance and current coverage, you are almost certainly underinsured. You probably did what I did when buying your home. I thought, “What’s the cheapest policy?” Then—boom—"I’ll take that one.”

Did I read it? No.

Did I understand what was in it for years? No.

Do I understand today? Yes, and so should you.

Terms to Know

You’ll come across many terms that you don’t use in everyday speech when you read about your coverage, and it’s crucial to understand what they mean. Let’s look at a few of them right now.

Deductible

This could possibly be a percentage of your coverage but is most commonly an actual dollar amount. A high deductible is a tactic used to lower monthly premiums.

Declarations or Coverages

This is a summary of what is being covered for your home. It should be towards the front of your policy and fairly easy to understand. It will show any discounts and coverage amounts, the address, the date the policy ends, and other basic but important facts.

Endorsements

I consider these to be connected to exclusions. Items like failed sump pumps or sewer back-ups can be excluded from coverage, but you can usually add them as an endorsement.

Exclusions

This should be its own section and may be listed as ‘Losses not insured’ or similar verbiage. I recommend going through this section word for word with a highlighter and making notes for yourself. Understanding excluded coverage may lead to requesting an endorsement to cover it.

Special Limits

I have a record collection that is very special to me. A large part of it was an inheritance from my dad. Not only does it have a high sentimental value, but it is also worth tens of thousands of dollars. This item and others like it would be placed in Special Limits if you wanted them covered. $20k diamond earrings in the closet? Get them covered in this section.

Conditions

This section could open the door to no coverage. The insurance company is essentially saying that if you deviate from these conditions, they can deny the claim. For example, if you have a break-in and wait to call the police, a condition may say that you need to call the police immediately. If they notice a gap in time, they have an excuse to deny the claim. Policies will specify certain conditions, and you should understand them. Sometimes these ‘small print’ items are listed as an endorsement.

Cost

You get what you pay for in the insurance world. Cheap premium? Expect a low payout with many limitations on what is covered. There are a few ways to gain a lower premium. The two I’ve seen have an impact are setting a high deductible and proving you have a whole-home security system. It’s even better if you have some smart house components that can sense smoke. Otherwise, shopping around is your other option. It may make sense to do this every five years or so.

Not having the coverage you need is mistake number one. It gets very complicated and expensive, depending on where you live. Do you live in a flood zone? Your base policy almost certainly excludes flood damage. If you live in a high-risk area for a natural disaster, getting quotes on coverage for that case should be researched. For example, I live in Seattle, so earthquake insurance is an endorsement to consider. Otherwise, insurance won’t cover any of the damage if an earthquake hits my home.

The Process

Xactimate is a program used by nearly all insurance companies. It uses a national database of pricing metrics adjusted to the market to produce the budget. However, some fatal flaws within this program skew the results. Make no mistake, this software is owned by the insurance industry, and some examples make me want to scream.

For instance, overhead is a blanket 10% (except in some areas around Washington DC, which allows 15%). No contractor has this overhead or is the same as another. They often don’t cover project management or supervision. The reality of buying material, loading it into a truck, and getting it on site, then offloading and installing it is not accurately captured. I’ve had entire roofs rebuilt without the crane being covered!

I could go on and on. Suffice to say, with a construction background, you can start poking holes in the Xactimate budgets pretty easily.

Because they rely on the Xactimate budget, your best defense is to use this as a base and build from it. This is called a supplemental. Adjusters not only miss scope items, but there are justifiable additional costs that can help the adjuster increase the Xactimate budget.

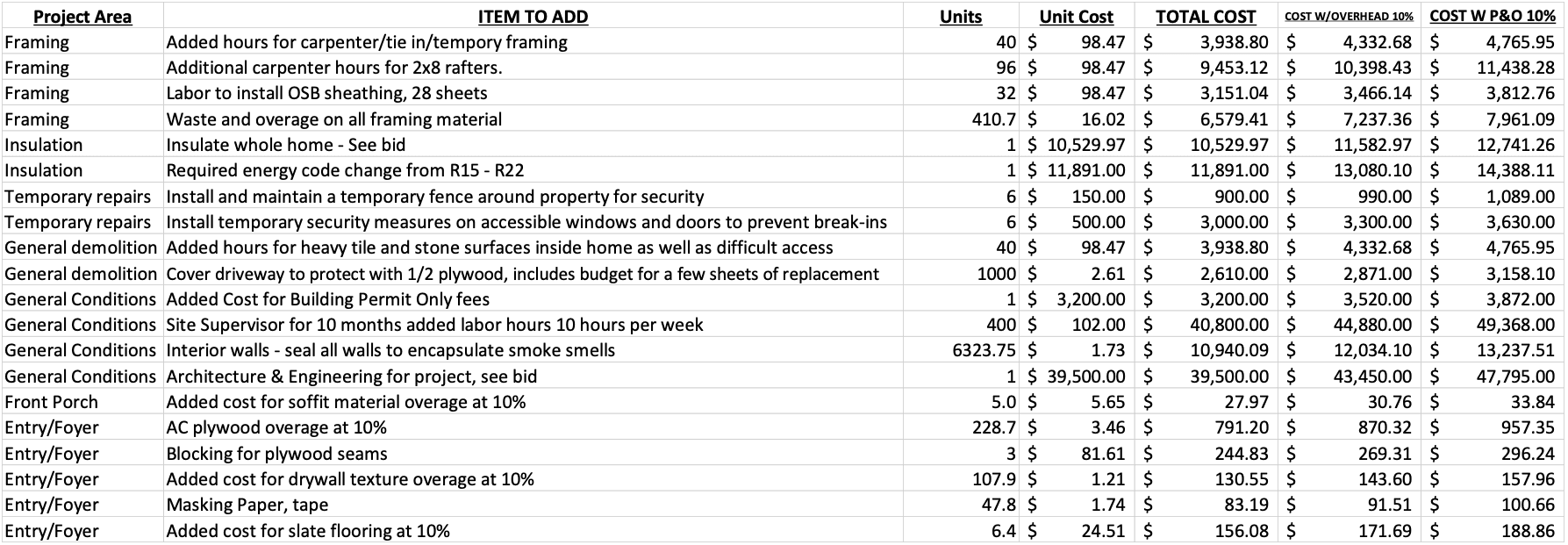

*The spreadsheet above is a snippet of a supplemental. These can be hundreds of line items. At the end, it subtotals and adds the insurance amount (which is the base) and tax. That total is the new amount requested.

My process is to go through what insurance sent, page by page, room by room, and add scope where I think it is missing. Getting bids from subcontractors is also very important, as those budgets are harder to push back on. This is time-consuming and tedious, but until there is a shift in how insurance companies pay out, this has been the most successful tool I’ve seen to legitimately increase the payout.

One Process That Can Work

There is no perfect process for handling an insurance claim. The best process I know to limit out-of-pocket expenses is to find a contractor who will work with the insurance company before work begins and produce a supplemental. It requires a good amount of time and money from the contractor, as they must meet, understand the project, and negotiate with insurance before the job even starts. Here’s the process as it should work, one I’ve personally been involved with many times:

An insurance event happens. A claim is started by the homeowner.

Demolition and water or smoke mitigation begin if needed. Any company that does this work can be used. They bill insurance separately. The homeowner can typically call and get this going immediately without insurance approval, especially in an event like my opening scenario. All policies will cover the initial clean-up and dry-out, as not doing so will lead to more damage.

Get an insurance adjuster assigned. If your claim is over 500k, that is typically the threshold for a ‘large loss adjuster.’ They will make a site visit and produce an estimate in Xactimate. The insurance company wants to close the claim and pay out, minus depreciation, and you should not allow this.

Interview contractors who have a track record of insurance success. This is the most important and hardest part. You will need to commit to this contractor. Keep a paper trail showing that you have committed to them. A good contractor may have a preconstruction contract, and this is money well spent.

Here’s a recent example of how important the contractor is for a successful insurance claim. A couple north of Seattle had a house fire—complete gut. It was a huge old house built by the owner of a lumber company in the early 1900s, using a ton of unique and interesting details. All the walls were plywood, for example, not plaster or drywall. Insurance wanted to settle for around $550,000, but this was easily 1.5 mil or more to put back as it was. After getting such a low number from insurance, they hired a public adjuster. This adjuster took a lot of time and produced a bid so high it didn’t make sense, which triggered the insurance company. The homeowners then went out to a contractor for a bid. This contractor took over six months and ended up never producing anything. They then went out and found a 2ndcontractor. This contractor took even more time and neither of the two bids reflected the original state of the home.

Time was now becoming critical since the fire, and the homeowners were desperate. We jumped in and produced a supplemental in Excel. We submitted it, met with the onsite large claims adjuster to review it, and settled for their maximum limits in just three months.

Once you get a contractor who can provide a more realistic quote to insurance, it is up to insurance to either accept or fight it. The smaller the project, the more likely they are to accept it. The bigger the project, the bigger the fight, but a good contractor will ultimately get more money for you than was originally offered.

Assuming an agreement is made, a check should be cut for the agreed amount. Every policy is different. Some may not have code upgrades, or they may have limits on various code upgrades. Some others may have limits on their total payout. Depreciation is another unknown. Some policies pay out, and some require proof, like pictures, after construction is done. Still others don’t pay out depreciation at all. A good contractor can help maximize payout, but the policy can sometimes be the limiting factor.

You will see two terms on your insurance estimate: RCV and ACV. ACV (actual cash value) takes depreciation into account. RCV (replacement cost value) is essentially the cost to replace today, and it does not consider depreciation. If your policy includes recoverable depreciation, you will get a check for the ACV amount. After construction is complete, the contractor will send pictures to insurance, and the remaining depreciation, which equals the RCV amount, will be paid.

This process is now complete. It seems like 99% of the time, the homeowner is not stuck with the initial insurance quote. We see small to large changes, but the point here is that contractors who understand how insurance companies work will use certain techniques to maximize insurance payout. This budget should not be referenced as the project moves to phase II; it’s a startover. There should be an architect with a new set of plans showing what is to be done, and it will be more than insurance will pay out, but insurance will pay for most of it. In the fire example, we ended up settling at 1.4 million (my supplemental totaled 2 million, but their limit was 1.4 million). The project they wanted cost 1.8 million. So they spent 400k, but they got a brand new house with a new elevator so they could age in place, and just about every square inch of the interior was new. All finishes were upgrades from what they had.

In a perfect world, as the homeowner, you would only pay out your deductible to insurance. Your settlement check should go into a high-yield savings account (actually, consult a financial expert on this one) to pay for the construction project you really want.

Public Adjusters

If you can’t find a contractor to negotiate with insurance, you could hire a public adjuster. Often, they are ex-insurance adjusters who work up an estimate for the repairs but with the homeowner’s best interest in mind, not the insurance companies.

I don’t have anything super negative to say other than to focus on one thing: their fees. It can often be a percentage of the claim. That can be a large dollar amount!

I would argue that entering a preconstruction contract with a general contractor is a better use of that money. Not all public adjusters are great, either. With a large claim, I’d pursue a good, well-established general contractor first, but a public adjuster is a tool to consider as well.

Don’t confuse a public adjuster with an independent adjuster. The latter are hired by the insurance company and have the company’s best interests at heart.

Quick Tips

Don’t wait to file a claim. Waiting will cost you. If it’s a loss, file immediately. You can do this online or by phone.

And don’t get denied due to negligence! Hire a gutter cleaning company, walk around, and check your home for red flags. Camera your sewer line periodically. Save the receipts! Home maintenance is a small cost that could be a big deal. Insurance often denies claims due to ‘homeowner negligence.’ Slow leaks and roof leaks tend to fall into this category, so do some poking around.

Another tip: take inventory of your home. Periodically, maybe every 3-5 years, you should walk through the entire interior and exterior of your home with your video camera/phone. Save this video on a thumb drive and store it somewhere off-site or in the cloud. This could have a big impact on your payout. If you don’t provide proof, the insurance company may assume a finish was cheaper than it was, for example, or not include it at all. Video evidence will help ensure everything gets captured.